Analysis of Global Trends in the Mineral Processing Industry

-

Geopolitical Reconfiguration Reshaping Supply Chains, Intensifying Resource Competition

Escalating global geopolitical conflicts are prompting countries to accelerate the construction of domestic and regional supply chains to reduce reliance on a single country or region. For instance, the United States is employing a "friendsourcing" strategy to diminish its dependence on China for critical minerals, while collaborating with allies to establish critical mineral alliances (such as the 2025 Quad Critical Minerals Initiative involving the United States, Japan, India, and Australia). This trend poses challenges for the mineral processing industry in terms of supply chain localization and regional segmentation, necessitating that enterprises adopt diversified resource layouts and flexible supply chain management to mitigate risks. -

ESG Becoming an Industry Entry Threshold, Driving Green Transformation

ESG (Environmental, Social, and Governance) has transitioned from a "bonus point" to a prerequisite for mining companies entering the market. International mining companies are enhancing their competitiveness through quantifiable ESG practices, such as adopting low-carbon mineral processing technologies, reducing water consumption, and minimizing tailings emissions. Domestically, guided by the "dual carbon" goals, sustainable development is being promoted through the construction of green mines. Mineral processing equipment must meet low-energy and low-emission standards, prompting enterprises to increase investment in green technology research and development. -

Accelerated Digital Transformation, Smart Mines as the Core Direction

New technologies, including artificial intelligence (AI), big data, and the Internet of Things (IoT), are reshaping the mineral processing industry. AI mineral exploration technologies enhance the efficiency of mineral prospecting by analyzing geophysical and geochemical data, while smart mines reduce operational costs through real-time monitoring of equipment status and optimization of production processes. For example, the refinement of the space-air-ground integrated remote sensing mineral exploration technology system and the green and automated development of low-grade refractory ore processing technologies exemplify the empowerment of mineral processing efficiency through digitalization. -

Diverging Supply-Demand Structures, Surging Demand for New Energy Minerals

Demand for traditional bulk minerals (such as iron ore and coal) is weakening, exacerbating supply surpluses, while demand for new energy minerals (such as lithium, cobalt, and nickel) is rapidly increasing. Although short-term supply surpluses have put downward pressure on prices, long-term supply gaps persist. Mineral processing equipment must adapt to the characteristics of different minerals, such as developing efficient flotation technologies for low-grade lithium ores or enhancing the efficiency of rare earth mineral processing through multi-force field and automated equipment. -

M&A Activities Focusing on Critical Minerals, Diverging Capital Flows

To ensure resource security, countries are strengthening their control over critical minerals through mergers and acquisitions (M&As). For example, Chinese enterprises have accumulated approximately USD 15.4 billion in M&A transaction values globally, primarily concentrated in new energy metals such as cobalt, lithium, and nickel. Meanwhile, the United States and its allies are accelerating domestic and friendly-shore mining development through government guidance and market investments. This divergence in capital flows will influence the regional demand for mineral processing equipment markets, requiring enterprises to adjust their market strategies to adapt to different regional policy environments. -

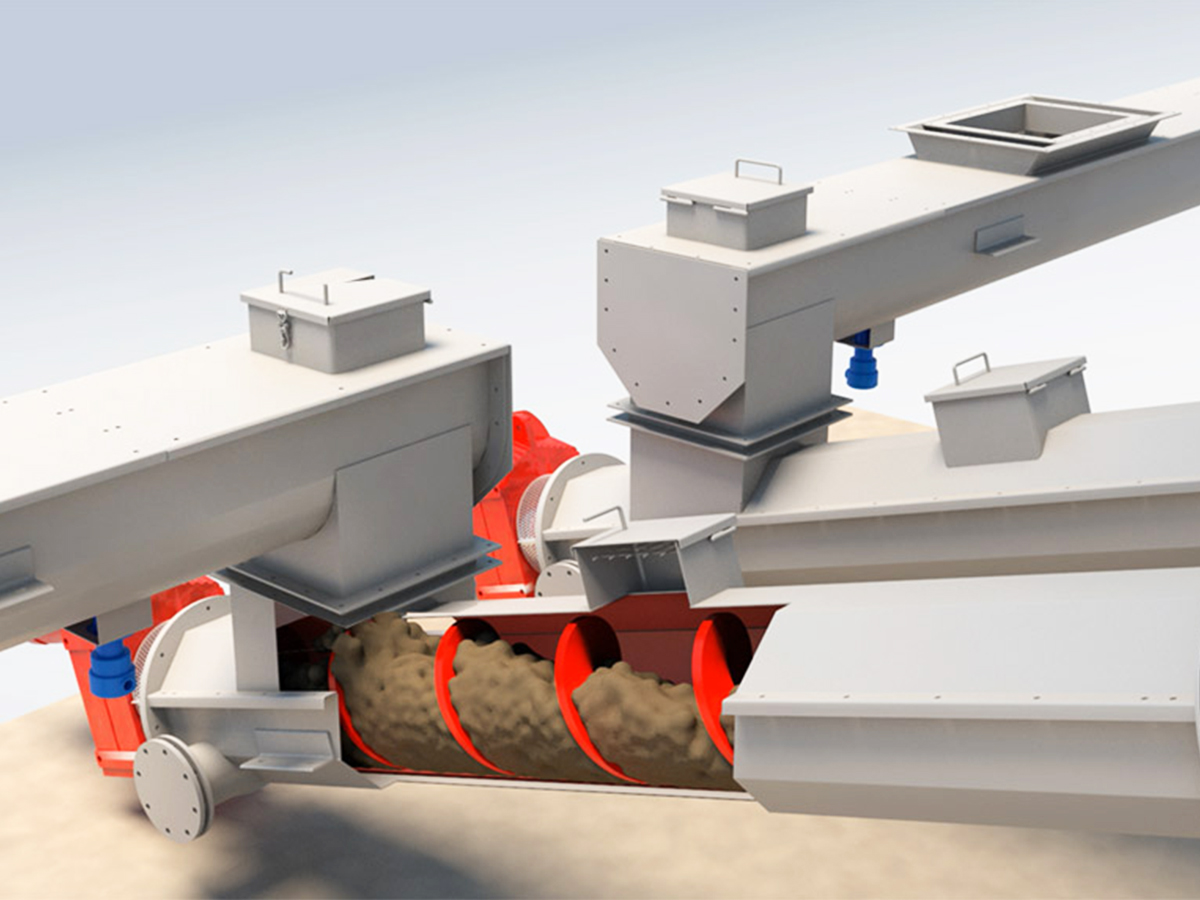

Technological Innovation Driving Equipment Upgrades, Emphasizing Both Large-Scale and Intelligent Solutions

Research and development in mineral processing equipment are focusing on large-scale, multi-force field, automated, and multidisciplinary solutions to meet the demands of developing low-grade mineral resources. For instance, large flotation machines reduce unit costs by increasing processing capacity, while intelligent control systems optimize mineral processing efficiency through real-time adjustments of operational parameters. Additionally, the green and automated development of low-grade refractory ore processing technologies is driving innovation in energy-saving and environmentally friendly mineral processing equipment. -

Adjustment of Global Mining Landscape, Deepening Regional Market Fragmentation

The core of global mining competition is shifting from "scale expansion + efficiency priority" to "resilience reconstruction + safety and controllability." For example, Africa has become the region with the largest increase in global iron ore capital expenditures, with the Simandou iron ore project expected to produce 30-40 million tons by 2026, with Chinese involvement playing a dominant role in advancing the project. This regional market differentiation requires mineral processing equipment enterprises to possess localized service capabilities to adapt to the resource endowments and policy requirements of different regions.